Undefeated Triangle MT4

EA “Undefeated Triangle” is an advanced system that exploits unique fluctuation between AUD, CAD, and NZD currencies. Historically results show that these pairs used in composition always return back first moved pair after fast movement in one direction. This observation can allow us to include a grid-martingale system where can get maximum points of these unique situations.

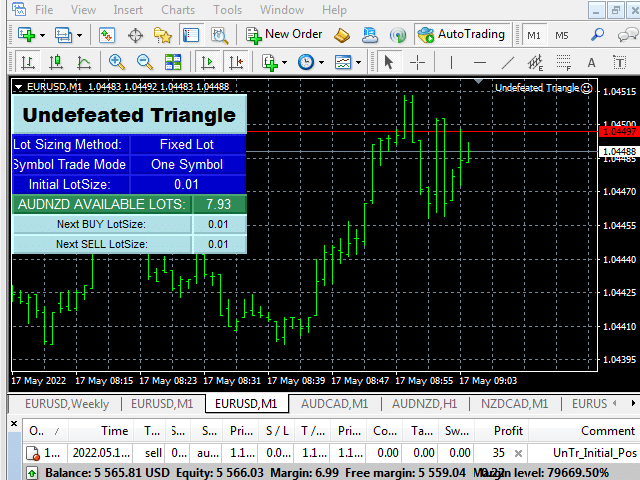

EA “Undefeated Triangle” uses only 3 pairs: AUDCAD, AUDNZD, and NZDCAD.

Advantages.

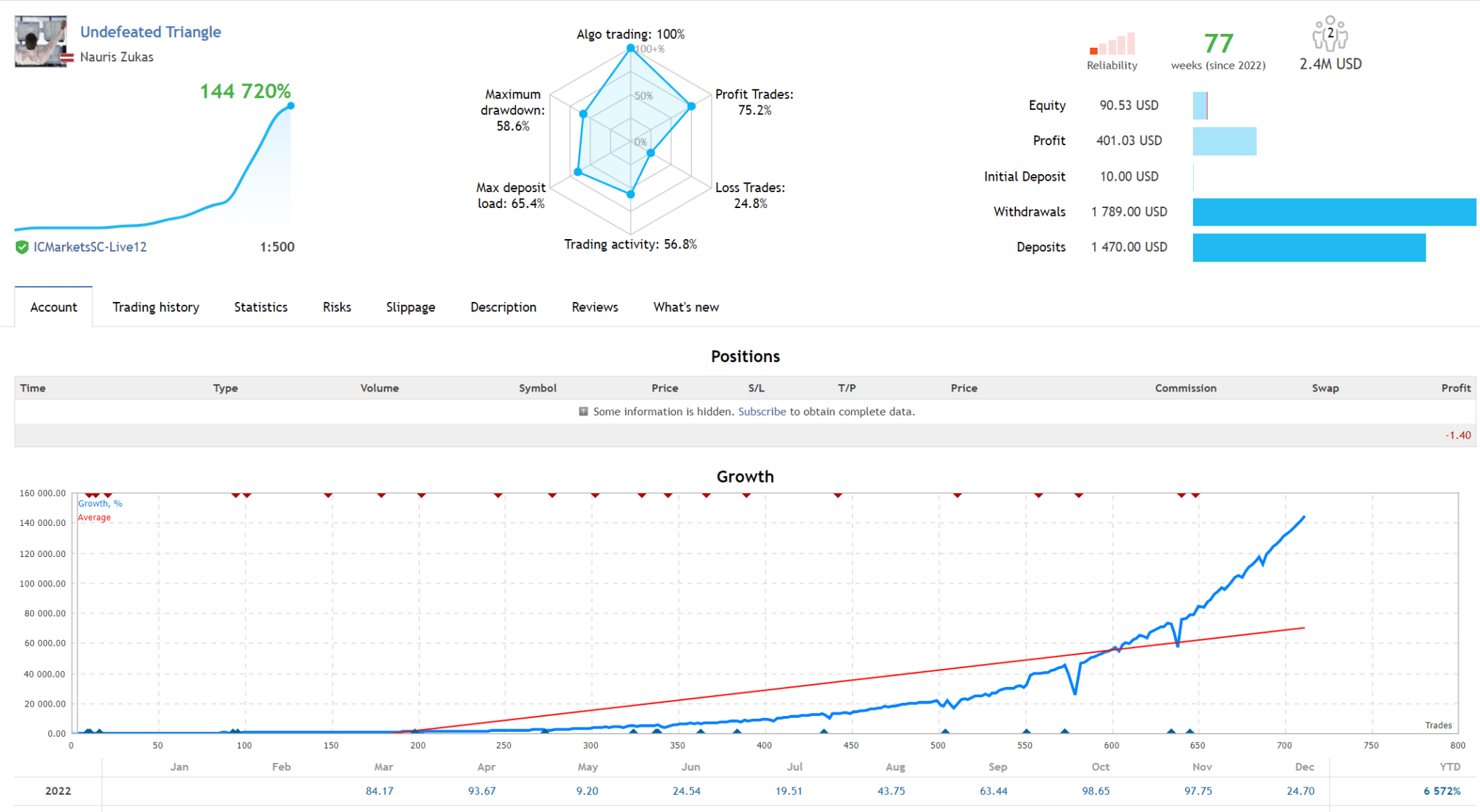

- Real account monitoring;

- Much cheaper than similar alternatives;

- Operate on mini accounts even 1 USD;

- No complicated needles parameters;

- Easy to use.

Parameters.

- Short Name (In Comment Section) – appears in Journal or Account History in the comment section;

- Print Logs On Chart – on/off Info-panel;

- Display Options – allow adjust for 4K display resolutions;

- One Chart Setup Pairs – list of selected pairs to trade (must change for suffix);

- Magic – identifier of trade position;

- No more Initial Trades (only grids) – no more new Initial Trades, only grids;

- Symbols open same time – number of symbols opened at the same time;

- *Lot Sizing Method – select the lot sizing method according to the risk you want to take;

- Fixed Lot – the size of initial trade;

- Deposit load % – value for adjusting your own initial lot size.

*Lot Sizing Method

- Fixed Lot – will use always a fixed lot on initial trade;

- Low Risk 20% annual – smart lot-size calculation based on account equity to get approximately 20% annual income;

- Mid Risk 40% annual – smart lot-size calculation based on account equity to get approximately 40% annual income;

- Significant Risk 80% annual – smart lot-size calculation based on account equity to get approximately 80% annual income;

- High Risk 120% annual – smart lot-size calculation based on account equity to get approximately 120% annual income;

- Maxed Risk – smart lot-size calculation based on account equity to get maximal annual income;

- Lots based on Deposit load % – lot-size based on account equity and margin requirement.

*With only 1:30 leverage I advise you not to use higher than “Low Risk” settings on a less than $6000 account, otherwise, you might have problems with free margin. With 1:100 and higher leverage, the “Significant Risk” setting (80% annual) for 1 symbol open at the same time should be ok a $333 deposit account, for 2 symbols open at the same time should be ok a $667 deposit account, and for 3 symbols open at the same time should be ok $1000 deposit account.

Requirements

- Supported currency pairs: AUDCAD, AUDNZD, and NZDCAD;

- Suffix (e.g. AUDCAD.a) should be included in the Setup Pairs;

- Timeframe: M15;

- The EA is sensitive to spread and slippage. I advise using a good ECN broker;

- The EA should run continuously;

- EA uses the adaptive lot-sizing calculation, but with low leverage (1:30 and lower) could be margin requirement problems on low equity accounts. As a solution, you can use Maxed Risk or Deposit load % method for adjusting your own initial lot size or increasing account equity.

Comments