FXMachine EA MT4

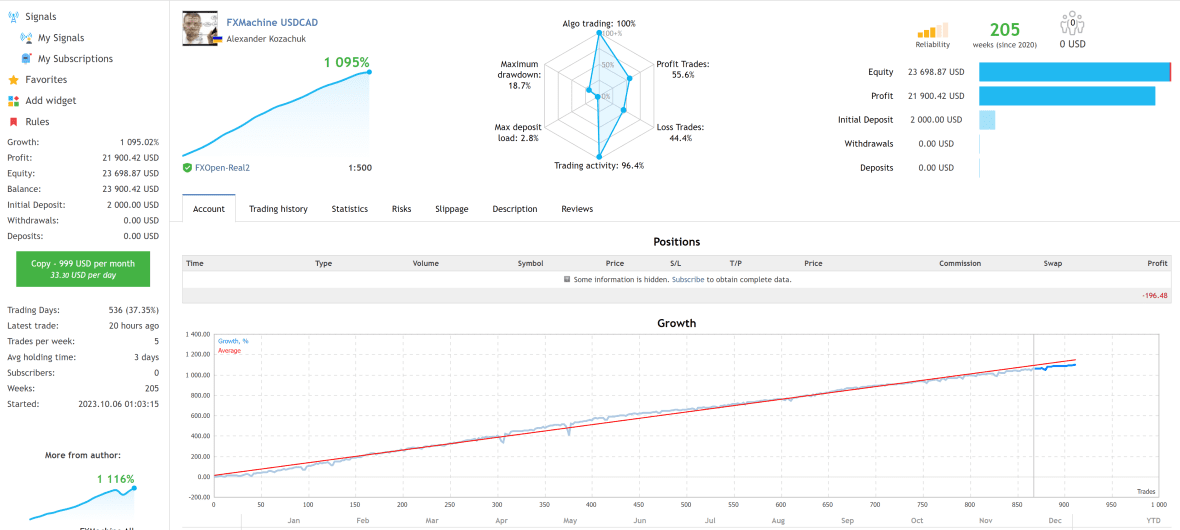

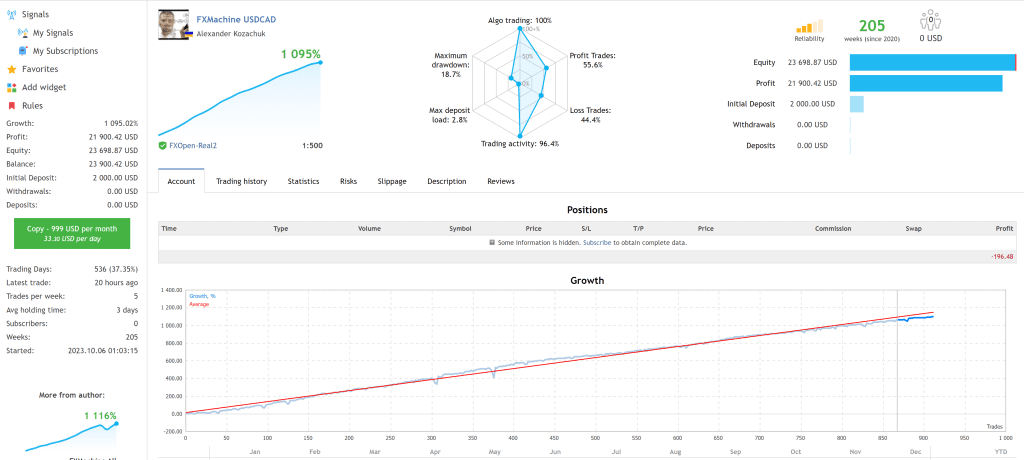

- Statistics on a real account since 2020

- Backtest for the last 13 years

- Low drawdown strategy

- Multi-currency algorithm

- Compatible with any broker

- Proven drawdown control system

Trading on a real account since 2020: Click Here

Trading on USDCAD, EURGBP, GBPUSD, EURUSD: Click Here

Trading on EURGBP: Click Here

Trading on GBPUSD: Click Here

Full backtests of the FXMachine EA are available for download here: Click Here

About us:

The development and support of FXMachine and our other robots is carried out by a professional team that has more than 14 years of experience in the Forex field. During these 14 years we have been improving our developments and finding better and more effective approaches to trading.

If you were to ask us what is the best piece of advice we can give for determining which EA is good and which is not, we would give the following answer: the most important thing is to look at the results of a robot trading on a real money account to see how many years of history it has and how well the EA performs. If the EA does not have statistics on a real account or it is only a couple of months long, then this EA cannot be good, believe us, we know this for sure. And it doesn’t matter how beautiful or perfect backtests it makes, there are a lot of algorithms and tricks on how to make backtest generation beautiful, but in real trading that will not work at all. The same applies to trading on a demo account.

About the development:

FXMachine is a highly intelligent trading system. We spent a lot of time working on it and improving it, and finally, at the beginning of 2020 we started our first live tests. It trades successfully to this day and shows quite a high profitability with low drawdowns, which you can see for yourself by looking at our trading statistics. We do not consider results on demo accounts to be relevant, so we provide results on real accounts only.

Principle of operation:

While developing FXMachine, we decided to use well-known and standard methods of Market analysis (indicators, price movement, bar analysis…) with a non-standard view and data evaluation. That brought unique results, and by continuing to work on them, we developed the most suitable algorithms for supporting orders that were opened based on these signals.

Our robot tries to open no more than 1-2 orders based on signals and close them in profit. If after some time and certain events, this order (or several) could not reach preferred goals (profits) according to the signal, then the system activates a mode of searching for an exit from this trade. At this stage, an order(s) may close at a small profit, sometimes at a small loss or at breakeven. If there are several orders opened by a signal, the system can try to close them all together to reduce risks, or in order to achieve a certain profit.

In a situation when it is not possible to quickly receive profit from an order, or minimize losses, and the order stays in the Market for too long, the next part of the program is being activated – the support algorithm. This algorithm allows you to significantly speed up the process of closing of orders in profit, without allowing a small drawdown that has formed to drag on for a long time. This allows us to stabilize the result, so that profitability could be consistent, and drawdowns, if they did happen, were rare and ended quickly.

Advantages and features:

FXMachine was developed based on simplicity and versatility, so that every trader could use our robot. FXMachine has the following advantages:

- Compatible with any broker and does not require special conditions for working. Trade with the broker that is convenient for you.

- Has an advanced drawdown control system that calculates StopLoss for all orders in such a way that it does not exceed a drawdown level you specify. It is much safer than monitoring a drawdown of all orders in the Market with “manual” closing (market closing) of orders in case of reaching a drawdown. Our method does not depend on the quality and stability of connection with a broker.

- Setting up the robot for both beginners and professionals. If you are a beginner or just don’t want to study the settings of the robot, then you only need 2 clicks to set it up – specify the drawdown limitation in percentages and click the “OK” button. And the robot will do everything for you according to the parameters prepared and tested by us. If you want more control over trading or make your own adjustments, then there is a section for manual settings in the EA, where you can set up everything yourself to meet your requirements, or even develop your own optimization of the parameters.

- Programmed for 4 currency pairs: USDCAD, EURGBP, GBPUSD, EURUSD. FXMachine is a multi-currency robot and has quite a universal principle of operation, so it can be optimized for any currency pair.

You can read a detailed user manual with the description of all the parameters here: Click Here

Troubleshooting and recommendations for backtesting:

- SPREAD. By default, the strategy tester in MT4 and MT5 sets the spread for testing as Current. In this case, it simply uses the value of spread that is currently in the Market, which can lead to an erroneous result on backtests, especially during weekends, because at that moment when the Market closes the spread can jump to 100-200 points (10-20 on 4 digits) and stay that way for the whole weekend. We recommend manually specifying a value of spread, which is an average usual for a pair being tested.

- LEVERAGE. Not everyone knows, but the strategy tester uses a leverage of the account that is currently logged into MT. That is, if a leverage of your account is 1.200, then the backtest will be made with an emulation of the leverage of 1.200. To test FXMachine, we recommend using a leverage specified in the recommendations above or setting it to 1.500, so there would be no problems due to low leverage under any testing conditions.

- LOSSES AT THE END OF BACKTEST. If a backtest is made for a long period of time or with a large starting deposit, then it could lead to the fact that at some point the maximum values of the possible lot will be reached (each broker has its own value). It will lead to losses and “steps down” on a graph, since the strategy will not be able to open a required lot for its order and it will lead to lost profit, which should have compensated for a previous loss. If this happens, we recommend either using a manual lot (in the AutoSettings parameter specify Use Manual Lot), or reducing the starting deposit, or considering an option of testing for a shorter period of time.